Best Crypto Exchanges in Canada in 2024

Best Crypto Exchanges in Canada in 2024

We at CCN have devoted a lot of time to comb through Canadian crypto exchanges. Here are the best we’ve found.

Review of Our Top 10 Crypto Exchanges In Canada

Here are our top 10 crypto exchanges in Canada right now. If you are new to the crypto industry, we recommend you start by checking out these services.

1. Blockchain.com

- €0.50 - $25

- spot trading

- margin trading

- staking 3

- Bitcoin

- Ethereum

- Bitcoin Cash 28

- Bank transfer

- Sepa

- Faster Payments 49

- English

- Spanish

- Portuguese 2

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

2. LBank

- 1750

- spot trading

- derivatives trading

- futures trading 5

- Ethereum

- Terra

- Polygon 241

- Visa

- MasterCard

- Bank transfer 255

- English

- Russian

- Spanish 27

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

- Polish 24

- Academy

- Guides

- Videos

3. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

- futures trading 3

- BitMEX Token

- Bitcoin

- TRON 8

- Visa

- MasterCard

- ApplePay 12

- English

- Russian

- Turkish 1

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

4. Okcoin

- 3.99%

- spot trading

- OTC trading

- staking 1

- Bitcoin

- Ethereum

- Tether 101

- Visa

- MasterCard

- ApplePay 107

- English

- United States

- Canada

- United Kingdom 26

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

- Videos 1

5. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

- perpetual contracts trading 8

- Ethereum

- Cardano

- Chainlink 231

- SwiftCash

- Bank Transfer (ACH)

- Sepa 308

- English

- Russian

- Japanese 6

- 2FA Google Authenticator

- English

- Japanese

- German 2

- Blog

- Videos

- Academy 4

6. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

- futures trading 7

- APENFT

- Bitcoin

- Ethereum 363

- Bank transfer

- Visa

- MasterCard 366

- English

- Chinese (Mandarin)

- Simplified Chinese 9

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

7. ProBit Global

- 0.0005

- spot trading

- staking

- wallet 2

- ProBit Token

- Bitcoin

- Geegoopuzzle 638

- Bank transfer

- Visa

- MasterCard 755

- English

- Azerbaijani

- Indonesian 42

- South Korea

- 2FA SMS

- 2FA Google Authenticator

- 2FA Microsoft Authenticator 2

- Arabic

- Bulgarian

- Czech 36

- Videos

- Learn and Earn

- Academy 1

8. BitMart

- 0.001

- spot trading

- derivatives trading

- futures trading 8

- Argentine Football Association Fan Token

- Berry

- Burn 1616

- Bank transfer

- Bank Transfer (ACH)

- Visa 1624

- English

- Spanish

- Japanese 6

- United States

- 2FA SMS

- 2FA Google Authenticator

- English

- News

- Videos

9. Bitstamp

- 0.0005

- spot trading

- staking

- wallet

- Bitcoin

- Ethereum

- Tether 74

- Bank Wire Transfer

- Bank transfer

- Faster Payments 86

- English

- Luxembourg

- United States

- Spain 1

- 2FA SMS

- 2FA Google Authenticator

- 2FA Microsoft Authenticator 1

- English

- Blog

- Learn and Earn

10. Coinbase

- 1%

- spot trading

- derivatives trading

- OTC trading 6

- Bitcoin

- Ethereum

- Tether 583

- Bank transfer

- Visa

- MasterCard 594

- English

- German

- French 9

- United States

- Canada

- United Kingdom 4

- 2FA SMS

- 2FA Mobile App

- 2FA Google Authenticator 2

- English

- Videos

- Tips and Tutorials

- Basics 4

Why Place Your Trust In Us?

We’ve built our platform on a foundation of expertise and extensive experience in the cryptocurrency space. Also, our team consists of seasoned professionals who have been part of the crypto revolution since its early stages.

We have witnessed the evolution of the crypto market. That allows us to translate complex concepts into an easily understandable form. CCN’s team members have a deep understanding of cryptocurrencies and crypto exchanges. We can provide you with the most accurate, relevant, and up-to-date information.

Commitment to objectivity and transparency

Our commitment to objectivity and transparency sets us apart. We understand that the crypto market is dynamic and filled with opportunities, but also has its risks.

We strive to provide unbiased information and thorough reviews. Critical analysis will help you make informed decisions, while our recommendations and reviews are based on careful research and analysis.

You May Also Like

Overview of the Best Crypto Exchanges in Canada in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

| ProBit Global | Invite a friend and earn up to 30% of their trading fees as a reward. | 4.67 |

| BitMart | Get Up to $3,000 Welcome Bonus when you sign up. | 4.50 |

| Bitstamp | Not Applicable | 4.50 |

| Coinbase | Earn $10 in Ethereum (ETH) when you stake $100 in ETH for the first time, up to $30 in rewards | 4.50 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

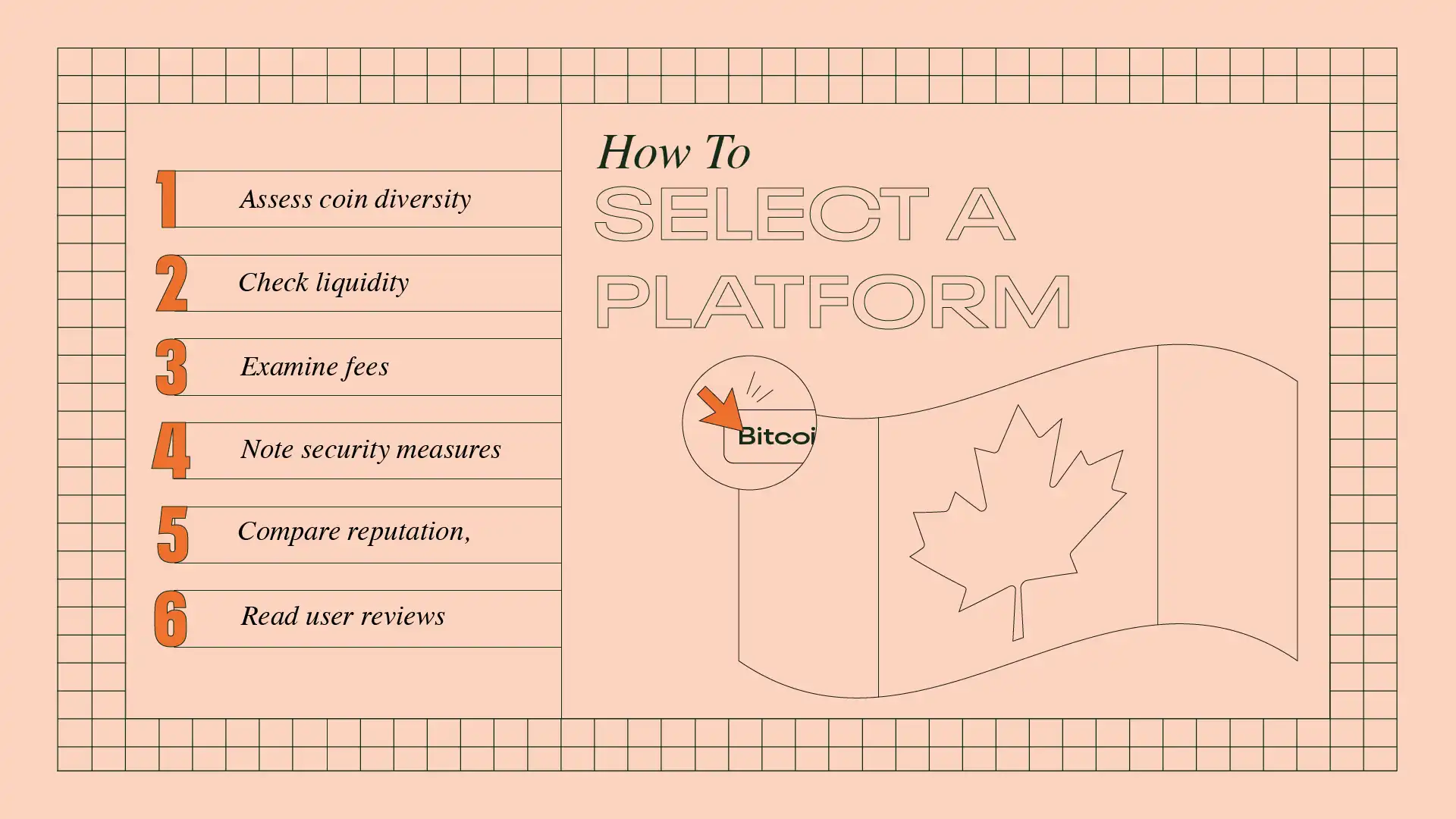

Choosing The Right Crypto Exchange In Canada

The selection of the right crypto exchange in Canada can shape your cryptocurrency journey. There are several key factors to consider before you commit to a platform. Let's look at some of them in detail.

Assess the coin diversity on Canadian crypto exchanges

The variety of coins on a crypto exchange grants you the opportunity to diversify your crypto portfolio. Some exchanges offer a wider array of digital assets than others, so make sure that your chosen platform supports the cryptocurrencies you want to trade.

This can range from mainstream coins like Bitcoin and Ethereum to emerging altcoins. Your trading strategies and investment goals will be key to deciding which coins you should look for.

Checking liquidity in the crypto exchange in Canada

In crypto trading, liquidity refers to how easily with which a cryptocurrency can be bought or sold. Exchanges with higher liquidity can handle large trading volumes without major decreases in price.

Websites like CoinMarketCap provide useful insights into an exchange's trading volume; that is, an indication of its liquidity.

Examining the fee structure

All crypto exchanges come with their own fees. These include costs for depositing, trading, and withdrawing funds. It's essential to review these before starting to trade on any platform.

Fee structures can vary greatly between different exchanges. Understanding these costs can help you select the most cost-effective platform.

Prioritize security

Security is paramount when you select a crypto exchange in Canada. Because of the potential vulnerability to hacks, it’s critical to opt for a platform with strong security measures.

Look for features such as two-factor authentication, biometric login options, and cold storage for funds. A secure platform can provide peace of mind and protect your investments.

Education resource availability

Informed decision-making is vital when you explore the volatile crypto market. An exchange that provides educational resources empowers users with knowledge and understanding.

These resources can range from guides on crypto basics to blogs discussing trading strategies. You could also find market analysis videos. Added to this, good tutorials help you stay updated and make informed trading decisions.

Evaluating educational resources

It is essential to ensure the educational resources are accurate and accessible. Accurate information keeps you informed about the latest market trend. Also, accessible resources enable you to understand complex crypto concepts, even as a beginner. Good quality educational materials can be a valuable tool in your trading arsenal.

Remember, the best crypto exchange in Canada for your needs is one that matches your specific trading needs and goals. Carefully consider each of these factors before making your choice. Happy trading!

The significance of licenses and geographical restrictions

Picking the best crypto exchange in Canada involves a lot of considerations. A couple of important ones are licenses and geographical restrictions. These components are pivotal in making sure that a platform is legitimate and reliable.

Explaining Canadian Crypto Exchange Licenses

I can’t stress enough how important the licenses of Canadian crypto exchanges are. Licensing is a fundamental aspect to consider, as it ensures that an exchange is operating legally. Engaging with an unlicensed operator exposes you to unnecessary risks, such as the potential loss of your investments.

The regulations for crypto exchanges vary widely across different regions. This can make things more complex, which is why you should make sure that the crypto exchange is licensed in your region.

Examining regulatory considerations

AML and CTF requirements

Regulators take into account numerous factors when granting licenses to crypto exchanges. Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) requirements are some of the most important ones.

This is because exchanges need to show they have robust procedures to prevent these illegal activities.

KYC requirements

Additionally, Know-Your-Customer (KYC) procedures are of significance. They ensure that the platform can identify and verify the identities of its users, promoting a safer trading environment. Lastly, solid security and risk management measures are very important.

This means that the crypto exchange should have effective protocols to protect users' assets. They also need to be able to manage any risks associated with crypto trading.

The best crypto exchange for you provides a user-friendly trading platform with a wide range of coins. Aside from this, it holds the necessary licenses and complies with local regulations. When you choose a crypto exchange, keep these factors in mind to ensure a secure and efficient trading experience.

Exploring offerings on the exchange

Crypto exchange offers a variety of products and services for the crypto community. These range from trading platforms and tools to individual and business services.

Diving into trading platforms and tools

Different crypto exchanges offer various trading platforms. Some are designed specifically for professional trading and offer advanced order types and customizable chart analysis tools. They can also give you in-depth order book insights and high-speed execution. This ensures you have all the tools you need for effective and efficient trading.

Spot, margin, and futures trading explained

Availability and benefits of spot, margin, and futures trading vary across exchanges. Experienced traders may find these options appealing, as they can take advantage of trades or hedge against potential losses. Choosing the best crypto trading platform that offers these features can enhance your trading experience.

Crypto wallets and storage options

When it comes to storing your cryptocurrency, various options are available. Some exchanges provide self-hosted crypto wallets. Still, many exchange wallets are custodial. These offer a level of security and control that can be comforting for many crypto users. Ensure your chosen exchange provides reliable storage options for your assets.

Services for individual traders

Exchanges offer a variety of services for individual traders. These include buying and selling crypto, earning crypto rewards. They can also allow borrowing cash using Bitcoin as collateral. Added to this, there is the option to create and collect NFTs. The best crypto exchanges cater to your needs and provide a comprehensive suite of services for you.

Services for business users

Crypto exchanges also cater to businesses. Services offered include institutional solutions and accept crypto payments. They can also include listing assets on the exchange, and trading in the futures market. If you're a business user, make sure your chosen exchange can accommodate your specific needs.

A variety of products and services are available on crypto exchanges. Choose an exchange that offers the right mix of platforms, trading options, and services.

Understanding accepted payment methods

Knowing the payment methods accepted by a crypto exchange make the transactions smoother. These methods range from digital wallets like PayPal to traditional methods. Traditional methods include bank transfers and credit cards. You can also use digital assets.

PayPal: An online wallet for your transactions

PayPal is a popular online wallet used on many crypto exchanges and online brokers, such as eToro. It allows you to deposit, store, transfer, and withdraw funds efficiently. PayPal also features two-factor authentication. That improves security, adding an extra layer of protection to your transactions.

Credit/Debit cards

Credit and debit cards, including Visa and MasterCard, are common payment methods on crypto exchanges. They allow you to send money directly from your bank account to the exchange. Authorization features like Verified by Visa add security to these transactions.

Bank transfers: A viable alternative

In some countries, using credit cards can be challenging. Wherever this is the case, bank transfers serve as an alternative payment method. In certain situations, these transfers are processed instantly, giving users quick access to trading on the exchange.

Digital tokens: Security and anonymity

On crypto-only platforms, on the other hand, digital tokens can be used as a payment method. This option offers the security benefits of decentralization, cryptography, and anonymous transactions. These features make digital tokens a popular choice among many crypto users.

How your payment method affects fees

The payment method you choose can impact the fees you pay. For instance, deposits using digital coins are often the most cost-effective. However, some methods, like PayPal, might incur withdrawal fees. It is important to consider the financial implications of your chosen payment method when trading on a crypto exchange.

Knowing the payment methods and their associated fees can significantly influence your trading experience. It's important to choose the payment method that best fits your needs.

Different Crypto Exchanges In Canada

Understanding the crypto world means that you need a solid knowledge of different types of crypto exchanges. These platforms typically fall under three categories: centralized exchanges, decentralized exchanges, and hybrid exchanges.

Centralized exchanges

Centralized exchanges are the most common type of crypto exchange. They function similarly to traditional banks, with a central authority that regulates transactions. These exchanges offer high liquidity and trading volume, making them a popular choice for crypto trading.

Pros

- High liquidity and trading volume

- Customer support and user-friendly interfaces

- Wide variety of cryptocurrencies

Cons

- Vulnerable to hacks

- Dependency on the exchange's security protocols

- Decentralized exchanges: A peer-to-peer approach

Decentralized exchanges

Decentralized exchanges operate without a central authority. Instead, they rely on blockchain technology to facilitate direct transactions between users. This type of exchange offers a high level of privacy and control over personal assets.

Pros

- Greater control over personal assets

- High level of privacy

Cons

- Lower liquidity and trading volume

- Difficult for beginners due to complex interfaces

- Hybrid exchanges: The best of both worlds

Hybrid exchanges

Hybrid exchanges combine features of both centralized and decentralized exchanges. They offer the security of decentralized exchanges and the liquidity and user-friendly interface of centralized ones. As a result, they are becoming a more popular choice of crypto users.

Pros

- High security

- Good liquidity

- User-friendly interfaces

Cons

- Still in the early stages of development

- Less available customer support

Whether you choose a centralized, decentralized, or hybrid exchange depends on your preferences. It's important to understand the features, advantages, and disadvantages of each type before making a choice.

Explaining The Operation Of Crypto Exchanges in Canada

One of the fundamental elements in the world of crypto trading is understanding how a crypto exchange operates. In Canada, these platforms play a big role in the cryptocurrency marketplace.

The essence of a cryptocurrency marketplace

A cryptocurrency marketplace is a digital platform where users trade cryptocurrencies. It works as a meeting point where supply and demand for various cryptocurrencies intersect.

At its core, a crypto exchange functions like a stock exchange. Buyers and sellers come together to trade based on the current market price of a specific cryptocurrency. The price fluctuates based on the supply (sellers) and demand (buyers) within the marketplace.

How does it work?

Every transaction involves two parties. One is the maker, who places a limit order below the market price or above the market price. The other is the taker, who places a market order that is filled instantly at the best available price.

Most Canadian crypto exchanges offer a variety of trading options. These range from buying and selling cryptocurrencies like Bitcoin and Ethereum to more complex trading features.

Security is a major focus for these exchanges. Many use a combination of hot wallets and cold storage to protect users' crypto holdings. Hot wallets are used for immediate transactions, while cold storages are used for long-term holding.

Variety of features

These platforms also deliver other essential features such as user-friendly interfaces, customer support, and various deposit and withdrawal methods. They often include Interac e-Transfer, credit cards, and wire transfers.

The operation of a crypto exchange in Canada revolves around providing a secure, convenient, and efficient platform for trading cryptocurrencies. It's a dynamic marketplace where supply and demand determine the price. Various features are in place to facilitate smooth transactions while ensuring security.

Learning To Buy Bitcoin

Bitcoin is a widely sought-after cryptocurrency. It offers a unique blend of decentralization, security, and potential for growth. The following steps outline how you can buy Bitcoin. These range from selecting a platform to securing your purchase.

Stepping into the world of Bitcoin acquisition

Your first step in buying Bitcoin is selecting a crypto exchange where you'll conduct your transactions. Canada hosts many crypto exchanges, each with varying features and security measures. Of course, it's essential to choose the one that suits your trading needs best. Look for an exchange with a user-friendly interface. They also need to have good security protocols, and responsive customer support.

Moving on to the payment process

Once you've picked a crypto exchange, you'll need to set up a payment method. Many Canadian platforms accept credit cards, e-transfers, and wire transfers. Select a method that best suits your convenience and the platform's requirements. Remember, some payment methods may incur additional fees, so choose wisely.

Placing your Bitcoin order

With your payment method ready, you can now place an order to buy Bitcoin. This process typically involves specifying the amount of Bitcoin you wish to purchase and confirming the transaction. Ensure you've checked the current market price and the platform's fees before finalizing the order.

Securing your Bitcoin

After purchasing your Bitcoin, it should be stored securely. Most crypto exchanges offer digital wallets where you can store your cryptocurrencies. However, for enhanced security, consider using a hardware wallet. This device stores your Bitcoin offline, away from potential online threats.

Exploring diverse purchasing methods

Beyond crypto exchanges, there are other alternatives. Other methods to buy Bitcoin include peer-to-peer transactions and gift cards.

Peer-to-peer transactions involve buying directly from another Bitcoin owner. Gift cards can be redeemed for Bitcoin on specific platforms. These methods may not provide the same level of security as established exchanges, so do be careful.

Buying Bitcoin involves careful platform selection and setting up a payment method. It also involves placing an order, and securing a storage. With due diligence and proper security measures, you can become a proud Bitcoin owner in Canada.

Bitcoin’s History

Bitcoin, the flagship cryptocurrency, holds a fascinating origin story. It is steeped in mystery and innovation. Understanding its history can help you better grasp its current status and potential future on crypto exchanges.

The dawn of a new digital era

Bitcoin's story starts in 2008. An entity using the pseudonym Satoshi Nakamoto published a whitepaper outlining a new type of digital currency: Bitcoin. This groundbreaking cryptocurrency aimed to facilitate peer-to-peer transactions without a central authority. It was a novel idea that disrupted traditional financial systems.

Bitcoin's initial footsteps

On January 3, 2009, Nakamoto mined the first Bitcoin block, also known as the 'Genesis Block.' The block's embedded message hinted at Bitcoin's potential to counteract banking industry flaws. This marked the beginning of Bitcoin's journey in the world of cryptocurrencies.

The growth and spread of Bitcoin

Over the years, Bitcoin's reputation and adoption grew. In 2010, the first Bitcoin exchange was launched. It allowed people to trade Bitcoin for traditional currencies. Since then, countless crypto exchanges have sprung up, transforming the cryptocurrency landscape. Today, Bitcoin stands as the most valuable and widely traded cryptocurrency.

Understanding Bitcoin's significance

Bitcoin's evolution serves as a benchmark for the growth of the cryptocurrency industry. Its creation introduced blockchain technology, the underlying tech of all cryptocurrencies.

Bitcoin's growing acceptance in mainstream financial systems has permitted the rise of various crypto trading platforms. These platforms have democratized access to Bitcoin, fueling its widespread use and growth.

In retrospect, Bitcoin's history is a testament to the power of innovation. From its humble beginnings to its current position as the leading cryptocurrency, Bitcoin has paved the way for a new era of digital assets. Its history underlines the potential of cryptocurrencies. It also shows the immense opportunities they present in the ever-evolving world of finance.

Canadian Crypto Law Overview

Crypto exchanges in Canada are recognized as money service businesses (MSBs). This classification falls under the jurisdiction of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). FINTRAC's role is to ensure exchanges have systems preventing money laundering and other illegal activities.

Provincial securities laws

Also, crypto exchanges must comply with the provincial securities laws. Depending on the province, they might need to register with the Ontario Securities Commission (OSC) or similar bodies. These regulations aim to foster fair trading practices and transparency, safeguarding investors' interests.

A noteworthy point is the evolving nature of cryptocurrency regulations. Staying updated and compliant with changing laws is paramount for the exchanges. Canadian platforms not only abide by these regulations but also deploy extra measures to ensure their users' asset safety.

While the legal landscape might seem intricate, it is in place to foster a safe trading environment. Being aware of these legal aspects will enable you to trade with more confidence. Your experience of the crypto world should be secure and regulated.

Tax Treatment Of Bitcoin In Canada

If you're an investor or someone interested in Bitcoin, it’s important to understand a few things about taxes. Your interaction with BTC can impact your financial planning and legal standing.

Be aware of the taxation of Bitcoin in Canada, which centers around the principle of capital gains. When you trade Bitcoin, make a profit, and cash out into fiat currencies like Canadian dollars, the profit is considered to be a capital gain by the Canada Revenue Agency (CRA).

This profit, whether it's hundreds or millions, is subject to taxation and must be reported on your annual tax return. Maintaining a list of your transactions is essential.

Mining

Bitcoin mining is another area subject to taxation. If you use your software and hardware resources to mine Bitcoin, the CRA requires you to declare the value of the Bitcoin you earn as income at the time you receive it. Remember, these rules apply to everyone, from the individual at their desk to a major company using vast resources.

Active trading

For the active traders among you who operate like a dealer, making a considerable number of trades, there are specific regulations. The CRA may categorize you as a business. That means your Bitcoin trading profits become business income and are taxed accordingly. This high-activity trading can be profitable but also brings its own set of tax obligations.

Using crypto as a payment method

A topic of increasing relevance is the taxation of Bitcoin transactions for goods or services. As Bitcoin becomes more widely accepted, more companies and customers use it as a payment method. The government has policies requiring these transactions to be reported as taxable events.

Modern technology has made handling these responsibilities easier. Cryptocurrency exchanges have developed apps for both Apple and Android users. These apps provide a way to efficiently manage your accounts, complete with functionalities for deposits and withdrawals, open and close trades, and stop and fill orders.

Understanding the tax implications of Bitcoin in Canada is a prerequisite for all Bitcoin investors and traders. Regulations and policies set by the government shape this financial landscape.

It's about being aware of your tax obligations, carefully tracking transactions, and safeguarding your assets. All of these steps, taken together, allow you to participate in the Bitcoin economy while staying on the right side of the law.

Final Word

Selecting the right crypto exchange in Canada is pivotal for navigating the world of cryptocurrencies. In this guide, we've highlighted the top 10 exchanges, presenting information such as fees, security, and promotions. Each exchange comes with its unique offerings, from Binance's fee rebates to Blockchain.com's staking options.

Our commitment at CCN is to offer an objective and transparent overview. We understand the dynamics and risks of the crypto market, aiming to provide unbiased insights to empower informed decision-making. By staying updated and considering these aspects, users can make prudent choices and engage with crypto exchanges in Canada confidently. Happy trading!

Frequently Asked Questions

What services do crypto exchanges offer?

Crypto exchanges offer a wide range of services. The primary service is the trading of cryptocurrencies. They allow you to buy, sell, and trade a wide variety of cryptocurrencies like Bitcoin, Ethereum, Cardano (ADA), Binance Coin (BNB), Solana, Dogecoin, and stablecoins.

Some platforms also offer advanced trading options. They include futures trading, margin trading, and leveraged trading. Other services can include staking. It means you can earn rewards by holding and supporting a cryptocurrency.

How much money do I need to use a Bitcoin exchange?

The amount of money you need to use a Bitcoin exchange can vary a lot. It depends on the exchange and currencies you want to buy. Some platforms allow you to start trading with as little as 1 CAD. Others might have higher minimum deposit requirements.

The minimum and maximum amounts can also vary based on your payment method. A wire transfer and a credit card payment might have different limits. They can also have different transaction fees.

.png)